“Global growth has slowed to the point that the global economy is dangerously close to falling into recession.”

This is how the World Bank sentences its dismal forecast for 2023, only three years after emerging from the recession induced by the 2020 pandemic. It estimates global growth will slow from 3 percent forecast six months ago to 1.7 percent.

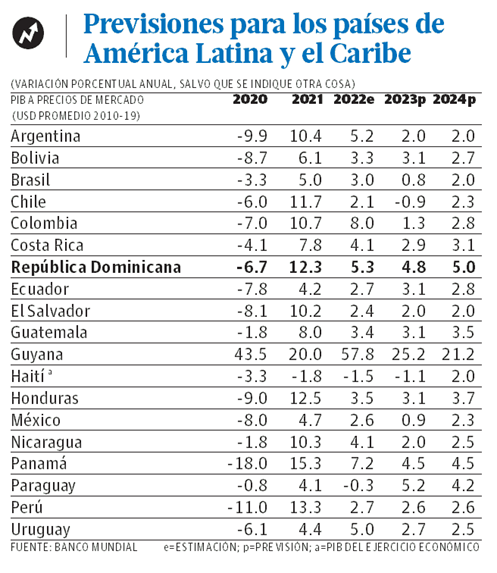

Despite the gloomy outlook, the agency forecasts that, among the largest economies in the Caribbean, growth in the Dominican Republic will average “a solid 4.9 percent in 2023 and 2024.” The percentage is slightly higher than the 4.6% predicted by the Economic Commission for Latin America and the Caribbean (ECLAC).

Meanwhile, the World Bank expects the Haitian economy to contract for the fifth consecutive year, this year.

“It continues to be beset by violence and instability, with nearly one in five children chronically malnourished,” the bank says about Haiti in its latest global outlook released yesterday.

Key: Forecasts for Latin American and Caribbean countries

(Annual percentage change, unless otherwise indicated)

GDP market prices

(US$ average 2010-19)

Source: World Bank e=Estimate; p=Forecast; a=fiscal year GDP

Global challenges

For 2023, the World Bank notes that “given the fragile economic situation, any new adverse developments—such as higher-than-expected inflation, sharp interest rate hikes to contain it, the resurgence of the COVID-19 pandemic, or intensifying geopolitical tensions—could push the global economy into recession.”

It would be the first time in more than 80 years that there have been two global recessions in the same decade. When it comes to recession, it defines it as a contraction in annual global per capita income.

It highlights that the world’s three main growth engines (the United States, the Euro area and China) are going through a period of pronounced weakness.

“Very high inflation has triggered an unexpectedly rapid and synchronous monetary policy tightening around the world to contain it, even in major advanced economies,” the bank says. “While this tightening has been necessary for price stability, it has contributed to a significant worsening of global financial conditions.”

In Latin America

The World Bank notes that growth in Latin America and the Caribbean is expected to slow sharply to 1.3% in 2023, to recover somewhat, to 2.4%, in 2024.

“Somewhat sluggish growth in the U.S. and China is expected to reduce export demand, while rising U.S. interest rates are likely to imply that financial conditions will remain tight,” he says.

To cope with a drop in investment, it suggests priorities. In countries with acute fiscal stress, it may be to improve the efficiency of public investment spending; in those with anemic private investment, it would be the reform of the business climate, to encourage private investment; and where there is large foreign direct investment, such as improving human capital to ensure that such investment enhances growth.

Source:

Diario Libre