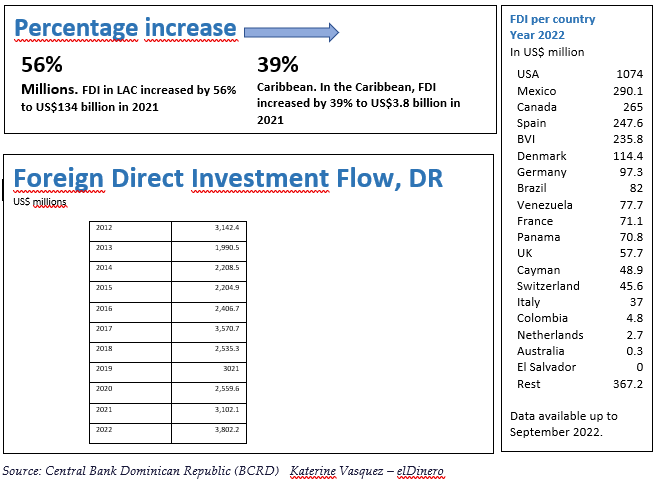

Foreign direct investment (FDI) flows in the Dominican Republic reached the unprecedented sum of US $ 3,802.2 million during 2022, thus exceeding the levels of 2021 by 22.57%, 2019 by 25.85%, and its highest amount registered in 2017, (US $ 3,500 million, 6.5%).

In fact, according to data available on the Export and Investment Center of the Dominican Republic (ProDominicana) website, by September last year, FDI had already exceeded the amount for 2021, reaching US $ 3,190.0 million, an additional US $ 779.1 million (32.3%) with respect to that period a year earlier.

As indicated, the flow seen that year was mainly driven by investments in the tourism (US $ 759.2 million), energy (US $ 687.3) and Commerce and Industry (US $ 524.1 million) sectors.

The Balance of Payments report for the CARD Region, for the third quarter of 2022, issued by the Central American Monetary Council (CMCA), highlights that the communication sector had an outstanding pace in the country, adding US $ 168.1 million in foreign investments. It is a sector that for several years presented negative indicators.

During 2022, the United States remained the country with the largest issuer of investments to the Dominican Republic, surpassing other countries by more than 1,000%. It totaled US$1,074.0 million in the first nine months, while Mexico registered US$290.1 million, followed by Canada with US$265.0 million, Spain with US$247.6 million. British Virgin Islands rounds out the five nations with the highest amount injected with US$235.8 million.

At the regional level, net Direct Investment (DI) flows (acquisition of financial assets minus net liabilities incurred) from Central America and the Dominican Republic (CARD) totaled US$7,603.3 million (2.9% of regional GDP). The amount is higher than the DI collected during the same period of 2021 (US$6,985.2 million, 3.0% of GDP).

Meanwhile, foreign direct investment received accounted for US$8,118.3 million (including intraregional investments), an amount 6.1% higher than that registered in the same period of 2021 (US$7,648.2 million). Likewise, it is basically due to the increase in the DI captured by the Dominican Republic, Honduras and Nicaragua.

In fact, according to the Central American Monetary Council report, these three countries are the main recipients of these resources in the region and together captured 86.3% of the total DI (including intraregional DI).

As of September, the Dominican Republic, Honduras, and Nicaragua showed increases in the flow of net DI, with increases of US$779.1 million, US$387.2 million and US$206.2 million, respectively.

During the first nine months of 2022, the region increased its direct investment liabilities with the rest of the world by US$8,423.3 million, essentially in shares and equity participations (US$7,337.0 million), where the reinvestment of profits has an important weight as a source of financing (60.7% of liabilities).

While in the Dominican Republic direct investment inflows totaled US$3,190.0 million, US$779.1 million (32.3%) additional compared to January-September 2021, Costa Rica received US$2,240.1 million for DI in 2022, US$361.1 million less compared to what was captured in the same period of the previous year.

Even so, the investments destined to companies manufacturing medical and high-tech implements stand out.

For its part, in Nicaragua net foreign direct investment totaled US$1,160.6 million, 21.8% higher than that seen in the same period of 2021 (US$952.9 million), with the manufacturing industry followed by energy and mines, Trade and Services being the economic activities with the highest collection of resources.

Revenue

As of September 2022, the balance of primary income (income) of Central America and the Dominican Republic totaled net payments of US$12,217.0 million. This was a year-on-year increase of US$1,046.1 million compared to the same period last year, the report said.

As indicated, this behavior was determined by the increase in the net payment of income from direct investment (US$1,512 million more). Among the total payments amounting to US$14,494.9 million, FDI (US$9,812.9 million) stands out, of which 50.1% corresponded to reinvested profits.

Interest payments (portfolio investment and other investment) totaled US$4,143.9 million; higher than that seen the previous year (US$3,882.3 million).

The CMCA details that, by country, the largest absolute increase in net payments was obtained by Costa Rica, influenced by the increase in the reinvested profits of direct investment companies; followed by Nicaragua (reinvested profits) and Honduras, with dividend payments and withdrawals of income from quasi-corporations.

On the other hand, the revenues received by the CARD region totaled US$2,277.8 million, US$628.8 million higher than those obtained in 2021 (US$1,649.0 million).

Most of them come from the interest generated by other investment (deposits and loans) and income obtained from reserve assets (international reserves), together with employee salaries.

Currency

The influx of foreign currency to the Dominican Republic during the first nine months of 2022 for exports of goods, tourism, remittances, foreign direct investment, and other income from services, amounted to US $ 29,115.9 million, US $ 4,118.8 million more compared to the same period of 2021.

Source:

El Dinero