In the interest of keeping economic agents and the general public properly informed and as part of its commitment to transparency and timely disclosure of data, the Central Bank of the Dominican Republic (BCRD) reports on the preliminary results of the economy as of March 2022.

Manufacturing Industry

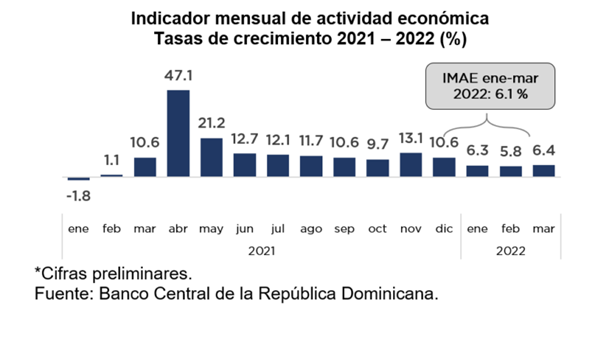

In March this year, the monthly economic activity indicator (MEAI) registered a growth of 6.4% which, together with the 6.3% variation in January and 5.8% in February, result in a 6.1% year-on-year expansion during the first quarter of 2022. This performance shows the resilience of the Dominican economy in facing the adverse effects of the international environment on domestic aggregate demand.

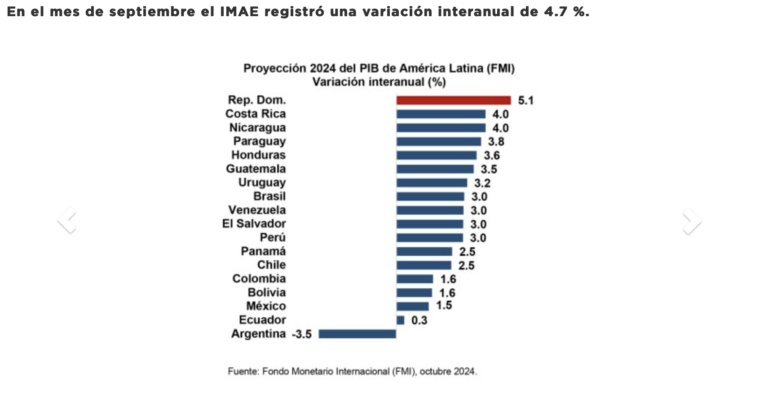

These results for the first 3 months of the year are in line with the forecasts recently released by the International Monetary Fund (IMF), predicting a 5.5% growth for the Dominican Republic in 2022, positioning it as the third largest increase at the end of the year.

Likewise, the Central Banks’ forecast models project an expansion of real gross domestic product (GDP) close to its potential of 5.0%-5.5% by the end of this year, as the risks caused by the geopolitical conflict and the COVID-19 pandemic are mitigated, which in turn should reduce the latent pressures on aggregate supply.

Key: Monthly economic activity indicator. Growth Rates 2021-2022 (%) MEAI Jan-Mar 2022: 6.1%

*Preliminary figures Source: Central Bank of the Dominican Republic

Among the economic activities that had the greatest impact on the increased business activity January-March 2022 are: hotels, bars and restaurants (39.3%), other service activities (11.0%), transport (8.8%), communications (8.2%), commerce (7.8%), energy and water (7.5%), health (7.3%), public administration (7.4%), free zones manufacturing (6.8%), construction (6.3%), among others.

The hotel, bar and restaurant industry showed an average year-on-year increase of 39.3% in terms of real value added, contributing around two percentage points (p.p.) to the MEAI result for January-March 2022. The dynamism of the sector is based on the external demand for the tourist services offered by the country, reflected in the arrival of 1,714,947 non-resident passengers during the first quarter of the year, mainly from the USA, equivalent to a year-on-year growth of 139.2%.

The average hotel occupancy rate is above 70% as of March. This performance continued into the month of April, according to the preliminary data offered by the Minister of Tourism indicating that 626,010 tourists arrived in the country, for a growth of 91% compared to April 2021.

Led by the Tourism Cabinet under President Abinader, the efforts of the Dominican Government have been crucial in supporting the reactivation of the sector. These remarkable results were achieved by implementing strategies to attract passengers from markets with growth potential while guaranteeing the stability of Dominican tourism in the face of changes in global consumption patterns and the conflict between Russia and Ukraine.

Likewise, the recovery of tourism has benefited from the significant improvement in the health situation related to COVID-19, supported by the efficient work of the Health Cabinet under Vice President, Raquel Peña. In fact, the positivity rate of the virus in our country has been around 1% during the last four weeks, while the case fatality rate, that is, the percentage of deaths among those infected stands at 0.7%, one of the lowest among the main advanced and emerging economies.

Key: Monthly economic activity indicator. Growth Rates 2022 (%)

Economic Activities 2022 Jan-Mar

Farming

Mining & Quarrie

Local Manufacturing

Free Zone Manufacturing

Construction

Services:

Water & Energy

Trade

Hotel, Bars & Restaurants

Transport & Storage

Communications

Financial Services

Real Estate & Rental Activities

Teaching

Health

Other Services

Public Administration

MEAI

*Preliminary figures Source: Central Bank of the Dominican Republic

On the other hand, trade and transport activities showed a notable increase in their value added of 7.8% and 8.8% respectively during the period in question. These two sectors are interrelated by the distribution chain of goods for local consumption.

The results are consistent with the sustained flow of local and imported goods into the economy, the increase in the volume of items transported to the points of sale for marketing, as well as the greater dynamism in the land transport of passengers, associated with the rebound in private consumption. The combined contribution of these two activities to the growth of the MEAI in January-March was 1.6 percentage points, that is, one third of the year-on-year increase of 6.1% referred to above.

As for the manufacturing industry, it is important to mention the 6.8% year-on-year increase in real value added of the free zones, reflected in the annualized increase of 11.2% in the sector’s exports, which totaled US$1,830.4 million at the end of March.

The branches that stood out for their nominal growth, valued in US dollars, and for boosting the manufacturing industry’s performance include exports of pharmaceutical products (48.1%), jewelry and related articles (21.0%), manufacture of medical and surgical equipment (19.7%), textile clothing (13.6%) and footwear manufacturing (4.1%). According to the information provided by the National Council of Export Free Zones (CNZFE), as of March, there were 182,214 employees in the sector and 740 companies in operation. Likewise, 11 permits were approved to set up new free zone companies, forecast to create approximately 837 direct jobs, as well as investments in the amount of RD$327.5 million.

Local manufacturing industry registered an increase of 4.2% in terms of value added, highlighting the performance shown in the month of March of an increase of 3.9%. This behavior is in line with the of manufacturing activity monthly indicator (MAMI) compiled by the Association of Industries of the Dominican Republic (AIRD), when the index reached a value of 63.7 in the month of March, higher than the 62.8 of the previous month and well above 50.0, a threshold from which the outlook of the sector is considered to be positive.

The construction industry also experienced an average year-on-year growth of 6.3% in January-March 2022, a variation that places the level of the volume index of this industry at 24.6% above that registered in January-March 2019 and 30.8% higher than in the same period of 2020. Thus, the activity continues consolidating itself as one of the most important in the Dominican economy, associated with its great multiplier effect and capacity to carry forward the rest of productive activities.

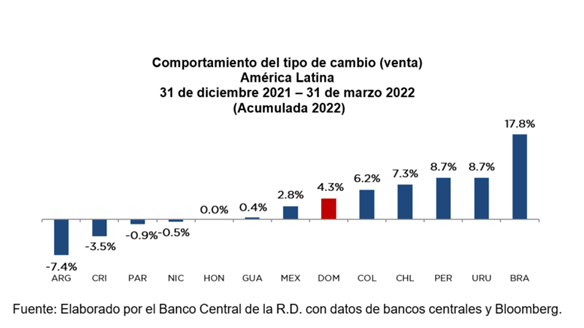

Key: Exchange Rate Performance in Latin America 31 Dec 2021 – 31 Mar 2022 (Accumulated 2022)

Source: Prepared by D.R. Central Bank with data compiled by central banks and Bloomberg

The development of residential, industrial and holiday projects with private capital, as well as important civil engineering and infrastructure works by the government, account for the increased activity of this sector during the first quarter. Similarly, the result at the end of March is mirrored in the performance seen in the local sales volumes of the industry’s main supplies, such as: rod (31.2%) and cement (2.6%), as well as by the income generated in the sale of the rest of the materials (34.0%). On the other hand, the imported volume of asphalt cement decreased by 1.1%.

Monetary policy and inflation

With regard to prices, inflation continue to be affected by more persistent than expected external pressures associated with rising prices for oil and other commodities important for local production, high freight costs and other disruptions in global supply chains, which have intensified with the conflict between Russia and Ukraine. Indeed, the average price of oil went from US$71.7 in December 2021 to US$108.5 per barrel in March 2022. In this context, the accumulated inflation during the first three months of the year reached 2.80%, while year-on-year inflation stood at 9.05% at the end of March.

Given this scenario, and taking into account the rapid economic recovery, the DR Central Bank continues to apply measures to counteract external impacts on prices and contribute to bring inflation within the target range. Indeed, since November 2021 the BCRD has increased its monetary policy rate by 250 basis points, to its current level of 5.50% per year, in line with the cycle of increases in interest rates internationally.

These monetary policy decisions are in line with the monetary measures applied in most advanced economies and in the Latin American region. With year-on-year inflation of 8.5% at the end of the first quarter of 2022, the highest level recorded in four decades, the US Federal Reserve increased the federal funds rate by 25 basis points to place it in the range of 0.25% – 0.50% per year, with additional increases expected for the rest of the year.

Latin American central banks have also continued to raise the benchmark interest rate. The increases in monetary policy interest rates of Brazil (975 basis points), Argentina (900 basis points), Chile (650 basis points), Paraguay (600 basis points), Peru (425 basis points), Colombia (425 basis points), Uruguay (400 basis points), Costa Rica (325 basis points) and Mexico (225 basis points) stand out.

Additionally, the DR Central Bank has complemented the increases in the monetary policy rate with measures aimed at reducing the surplus liquidity of the financial system, through open market operations and the gradual return of resources that had been granted during the pandemic. Indeed, these measures have succeeded in accelerating the transmission mechanism of monetary policy by affecting the adjustment of domestic interest rates and moderating the growth of monetary aggregates to around the expansion of nominal GDP.

In particular, the circulating currency (M1) showed a year-on-year growth of 16.0% in March 2022, while the extended money supply (M2) and broad money (M3) showed a year-on-year expansion of 9.4% and 10.0%, respectively. Meanwhile, credit to the private sector in national currency maintains its busy, expanding by 12.6% year-on-year during the same period, forecast to close the year at around 8%-10% to the extent that the transmission mechanism of monetary policy operates.

In this active monetary policy scenario, the DR Central Bank’s forecasting system indicates that inflation will gradually converge to the target range of 4.0% +/- 1.0% over the monetary policy horizon. It is important to note that the monetary normalization measures are being complemented by a package of initiatives implemented by the Government to mitigate the impact of higher international prices of raw materials through fuel price freezes, subsidies on domestic production and for households, especially the most vulnerable. These monetary and fiscal measures, together with the stability seen on the foreign exchange market, are elements that will help to gear inflation towards its target range.

On the other hand, fiscal policy is characterized by the an increase in collections, which expanded by more than 20% year-on-year at the end of March. In fact, the total revenues of the General Directorate of Internal Taxes (DGII), the General Directorate of Customs (DGA) and the National Treasury are about RD$20,780.9 million above what was budgeted at the end of March 2022. These higher revenues have provided the necessary space to apply measures aimed at mitigating the adverse external impact and helping to preserve macroeconomic stability.

Trade sector

The trade sector maintains a remarkable performance, reaching total US$3,302.8 million in exports of goods in January-March 2022, for a year-on-year growth of 13.7%, led by domestic goods which increased by US$213.4 million (annualized increase of 16.9%). Exports from free zones stood at US$1,830.4 million in January-March 2022, expanding by US$184.1 million equivalent to an increase of 11.2%.

Tourism revenues came to US$2,109.8 million in the first quarter of 2022, a figure higher by US$1,302.1 million (161.2%) than the same period of 2021, supported by the arrival of 1.7 million tourists in the first three months of this year.

On the other hand, remittances stood at US$2,396.2 million, explained by the favorable working conditions maintained by Dominicans living abroad, mainly in the USA.

A striking sign that investors remain confident in the strength of the country’s macroeconomic fundamentals is that foreign direct investment increased in annualized terms by 11.3% in January-March 2022, reaching a sum of around US$1 billion. This amount is in line with the outlook for the end of this year, which amounts to US$3,410.3 million, comfortably financing the current account deficit forecast for that year.

Total imports reached US $ 6,946.0 million at the end of March 2022, driven by the increase of 79.2% in oil companies compared to the previous year. Meanwhile, non-oil imports stood at US$5,660.2 million, showing an increase of 32.5% during the first quarter of 2022.

The favorable performance of the foreign exchange generating sectors contributes to maintaining the relative stability of the exchange rate, reflected in a cumulative appreciation as of March 31 of 4.3%. Likewise, this important flow of foreign currency has allowed international reserves to remain at historically high levels, around US$ 14,596 million at the end of March, equivalent to 13.6% of GDP and 7.1 months of imports, thus exceeding the metrics recommended by the IMF.

Financial and payment system

At the end of March 2022, financial intermediation entities registered assets of RD$2,770,609.7 million, a 14.6% growth, compared to what was presented in the same month of 2021, mainly favored by the increase in cash and cash equivalents and the total net loan portfolio in national currency placed to the private sector.

Earnings for the year before income taxes amounted to RD$16,916.3 million, for a return on equity (ROE) and on average assets (ROA) of 21.2% and 2.4%, respectively. The delinquency of the loan portfolio was 1.0%, well below the historical average.

According to information published by the Bank Superintendency the greater capitalization, as well as the generation of profits, has helped the entities maintain their solvency position, standing at 18.9% as of December 2021, allows them to comply with the minimum 10% regulatory requirements under the current legal provisions.

As far as multiple banking is concerned, which represents 88.1% of the national banking system by its asset levels, it presented a solvency of 16.4%, the return on equity amounted to 23.6% and on its assets to 2.4%. Likewise, the delinquency of its loan portfolio was 1.0%.

Regarding the behavior of payment systems during the first quarter of 2022, the number of payments settled in the Real Time Gross Settlement (RTGS) system increased by 146% compared to the same quarter of the previous year, meaning that the number of transactions increased from 2.7 million in 2021 to 6.6 million in 2022. Within the total payments, it is important to highlight the increase in automatic operations through this system, going from 2.3 million in January-March 2021 to 3.3 million, in the same period of 2022. This service allows bank customers to transfer funds and make payments in real time. This demonstrates that bank users are using electronic payments more frequently, in line with the dynamism that the Dominican economy has been showing.

Finally, it is important to note that the Dominican economy has strong macroeconomic fundamentals and proven resilience to face challenging conditions in the international arena. In this regard, the Central Bank of the Dominican Republic remains committed to achieving the inflation target over the monetary policy horizon and the proper functioning of the financial and payment systems, in order to preserve macroeconomic stability.

Source:

Hoy