- Impact of the repeal of Law 158-01

The recently proposed Tax Modernization Bill by the Executive Branch turns out to be a euphemism for the tourism sector.

In terms of fiscal modernization, it contributes nothing to the sector. It is a regressive bill for the sector because it reduces its competitiveness compared to countries on the continent, mainly Mexico (mostly Cancun and Playa del Carmen), Jamaica, Puerto Rico, and Cuba.

The Government’s proposal has been to almost entirely repeal Law 158-01 of 2001 and its amendments on the Promotion of Tourism Development, leaving in force the articles that create the Tourism Development Council (CONFOTUR). The reason is simple: the Dominican State granted tax incentives through an administrative act issued by CONFOTUR, originally for a term of 10 years, and from the modification of the law in December 2013, for 15 years, to hotel and complementary tourism projects. Therefore, even with the law repealed, this regulatory body must remain in force until 2039 to ensure that the projects approved until this year, 2024, enjoy the granted tax exemptions and comply with the provisions of the law.

Article 110 of our Constitution establishes the legal principle of non-retroactivity of laws. In a government that prides itself on being “essentially civil, republican, democratic, and representative,” it could not be otherwise, as concluded in her 1957 thesis by the great Minerva Mirabal de Tavárez when she noted: “Being the principle of non-retroactivity a constitutional rule, it must be respected not only by the judges who apply the laws but also by the Congress that makes them, and in general, by all official bodies and authorities.”

Thus, repealing Law 158-01 will not result in fiscal revenues for the Dominican State other than those derived from new tourism investments in the coming years, which will not enjoy tax exemptions on income tax, IPI (Real Estate Tax), property transfer, and others.

I will limit myself to noting that ASONAHORES, which in its 60-year history has distinguished itself by its prudence, restraint, and above all, its tact in the private-public sector relationship, has said the following:

It is estimated that tourism contributed a total of US$22 billion to the Dominican economy in 2022, equivalent to 19% of the country’s GDP.

The tourism sector contributed 29% of foreign exchange generation in the last decade; three out of every ten dollars that enter the Dominican economy come from tourism.

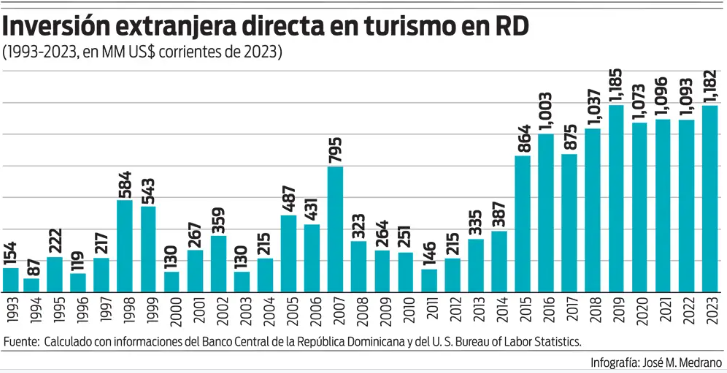

Fiscal revenues and foreign direct investment (FDI) in tourism generate twelve times the sector’s tax expenditure.

If there is a 50% drop in foreign investment in tourism and a 30% decrease in passenger arrivals, it is estimated that the reduction would be around US$7 billion less in foreign exchange income.

The country needs an estimated US$33 billion in direct investment to reach the goal of 20 million tourists.

I conclude by stating that while I do not believe that repealing Law 158-01 will result in a significant drop in visitor arrivals in the next four years, it will have an immediate effect on the flow of national and foreign investment in the tourism sector. Therefore, in four years, we will discover that this measure was counterproductive because we affected investment flows and did not compensate with increased tax revenues.

We will have lost competitiveness and discovered that “we are a country in the world” is different from “There is a country in the world placed in the same path of the sun.” Let us reflect and dialogue. If the pandemic forced us to create instances of dialogue and cooperation and we excelled as a country, success cannot be the cause of a change for the worse.

Source: