By the end of 2024, it will have generated 11 billion dollars, created 400,000 direct and indirect jobs, and contributed 25% of the cumulative growth recorded in GDP over the past three years (2022-2024). Standing out as no other sector in the economy, tourism has become the preferred target of experts when designing fiscal reforms aimed at increasing revenues through the reduction of tax exemptions. Official estimates indicate that out of the total tax expenditure of RD$340.891 billion resulting from all current tax exemptions in the country in 2024, the tourism sector accounts for RD$12.570 billion, which is 3.7% of the total tax expenditure.

If overnight we were to eliminate all tax exemptions for new investments in the tourism sector, while respecting those already granted until their expiration, and hypothetically assuming that dismantling all exemptions would not reduce national and foreign private investment levels in the tourism sector, the additional revenues to the government would reach approximately RD$2 billion in the first year, equivalent to 0.027% of GDP. When every single company in the tourism sector no longer enjoys exemptions, the government would have succeeded in increasing revenues by 0.17% of GDP, in addition to potential fiscal incomes from new hotels and tourism real estate developments established in the country post-exemption dismantling.

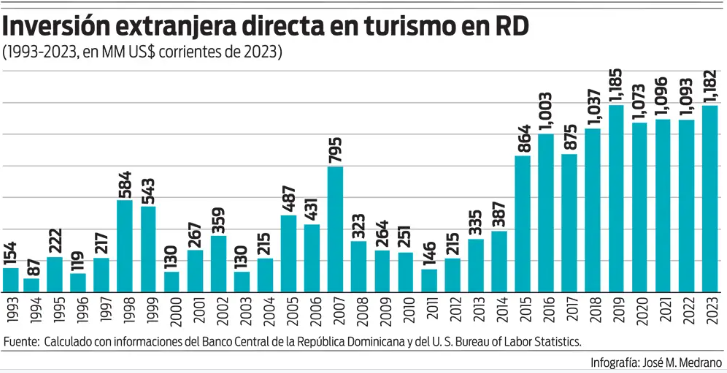

The trade-off between benefits and costs induced by exemptions undoubtedly suggests that the Dominican model for attracting investment in tourism infrastructure has possibly been one of the most successful worldwide. We have managed to attract an average annual FDI of US$1.031 billion into the tourism sector during the period 2019-2023. Cumulatively in current US dollars as of 2023, foreign direct investment in the tourism sector totals US$16.069 billion from 1993 to 2023. This investment has provided direct and indirect employment to hundreds of thousands of young Dominicans, primarily graduates of a public education system that restricts their access to higher-value-added enterprises requiring well-qualified human resources.

The above preamble should not lead the reader to think that we favor maintaining the current system of tax exemptions that stimulate investment and development in the tourism sector. Rather, it aims to send a clear message about the need to act prudently and wisely when making decisions to rationalize exemptions offered to the tourism sector and any other sectors like construction, which have been fundamental pillars of Dominican economic growth in recent years. If we irrationally weaken the sources of economic growth and thus the country’s tax revenue base, the revenue stream from any eventual reform could fall well below estimates.

The first consideration should be whether the dismantling of tax exemptions for the tourism sector should be “across-the-board,” meaning without discrimination between tourism poles in the country. Economists, especially those confined to textbook teachings and unfamiliar with the complexities of political economy, often favor public policies that embrace uniformity. However, practical wisdom sometimes dictates that uniformity must yield to selectivity or differentiated treatment. Not all tourism poles in the country exhibit the same level of development. Therefore, if tax exemptions have been a significant factor in stimulating private investment in the tourism sector, they could be used to promote investment in lagging or emerging tourism poles. This greater geographical diversification of investment in hotels and tourism resorts would not only promote better regional equity but also provide owners of hotels in more developed poles, more exposed to hurricanes and seaweed, with the ability to divert tourists to their hotels in less vulnerable areas if necessary. For instance, it would be contradictory not to maintain investment incentives across the entire Amber Coast (Atlantic).

What could be done for the more developed poles that could better handle a rationalization of exemptions? Firstly, respect exemptions already granted until their expiration, including those for approved projects commencing construction before June 30, 2025. Secondly, eliminate the distortion and lack of transparency caused by the Advanced Price Agreement (APA), through which hotels settle Income Tax and VAT using room rates agreed upon by the DGII, which on average have been less than half of the actual rates charged by hotels. The APA should be eliminated, and the DGII, supported by the Ministry of Tourism, should use the actual rates charged by hotels, regardless of any portion collected by tour operators. Once the APA is eliminated, reduce the VAT rate on hotel accommodation services from 18% to 9%. It’s worth noting that accommodation for foreign visitors is an export service. Therefore, if VAT does not tax the export of goods, it should not heavily tax exported services provided within the national geography. In most European countries, the VAT charged by hotels is half the standard VAT rate. This 9% VAT would also apply to services provided by companies to airlines, including meals prepared for passengers, as these services are provided while the aircraft is parked in national territory. We could enter the tourism shopping map if we establish an “ITBIS-Refund” for foreign tourists.

Regarding hotel income tax, we suggest the government consider collecting this tax through a rapid determination scheme. In 2018, according to DGII publications, a total of 811 hotels reported tax returns that, when consolidated, showed losses of RD$1.359 billion. In 10 of the 13 years between 2006 and 2018, hotels in the country reported consolidated losses. Hotels should be left alone with their accounting, especially considering that these losses may have been due to hotels, using APA rates to account for their revenues, being forced to undervalue their operational incomes. Once the APA is eliminated, hotels that have exhausted their years of income tax exemption should be subject to a minimum income tax equivalent to 4% of total gross revenues (all-inclusive packages, room rentals, food and beverages, and all other revenues). In 2018, with the APA eliminated, this minimum tax would have generated revenues equivalent to 0.25% of GDP.

Regarding the Real Estate Property Tax (IPI), there are two options. The first is to respect the remaining exemption years for foreigners and nationals who, attracted by the exemption from this tax, purchased properties in resorts and real estate development projects under Law 158-01 for the Promotion of Tourism Development. The second option is similar to the first but includes a component of easily justifiable social solidarity. We all recognize that the sector that received the most support from the Abinader administration to face the economic collapse caused by the pandemic and emerge from it as quickly as possible was the tourism sector. No other country exhibited as extraordinary a recovery as ours. Part of this effort was financed with a significant increase in public debt that is now being paid by all individuals and businesses that do not benefit from exemptions. While the state raised the arm to keep the hotel sector afloat, all owners of apartments and villas in the country’s tourist resorts have seen unprecedented appreciation in the value of these properties in recent years and a significant increase in their rents. Given this situation, it would be more than justified for the fiscal reform to be presented by the Executive Branch before the end of this year to include a Solidarity Tax to Serve the Public Debt Induced by the COVID-19 Pandemic of 1% on the value of real estate properties owned by natural and legal persons and legal entities established in tax havens whose ultimate beneficiary is Dominican and who are currently exempt from IPI under Law 158-01.

We believe this proposal blends economic sensibility, regional equity, administrative pragmatism, and social solidarity, while enhancing the government’s revenue capacity from the tourism sector without significantly eroding the dynamism of the sector that has contributed the most to Dominican economic growth post-pandemic.

Source: