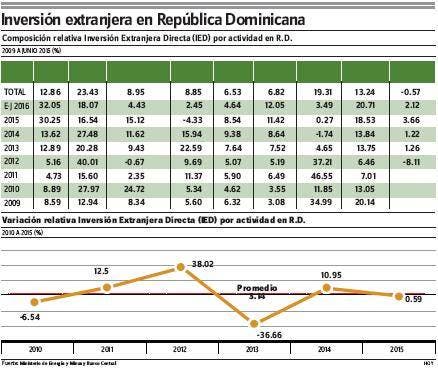

La Inversión Extranjera Directa (IED) acumuló US$17,219 millones desde 2009 hasta junio de 2016. Los principales sectores de crecimiento fueron comercio e industria, 23.43%; minas, 19.31%; inmobiliarias, 13.24%; turismo, 12.86%; telecomunicaciones, 8.95%; electricidad, 8.85%; zonas francas, 6.82%, y finanzas, 6.53%, según el Banco Central de República Dominicana (BCRD) y un análisis del Barómetro de Energía y Minas (BEM).

Los datos permiten constatar que el sector minero-eléctrico comprende el 28.16 por ciento de la totalidad de la inversión foránea en el país.

En promedio, la tasa de crecimiento de las inversiones directas en el país registró 3.14% de 2010 a 2015, con un pico de 38.02% en 2012, en gran medida a causa de las cuantiosas inversiones de Barrick Pueblo Viejo, y luego en 2013 registró una caída de 36.66%, a raíz de voluminosas desinversiones llevadas a cabo por varias corporaciones y la bajada pronunciada de las afluencias inversoras al país.

La publicación resalta que de 2010 a 2015, los tres primeros puestos de inversiones directas fueron ocupados respectivamente por turismo, US$486 millones; zonas francas, US$187 millones, y telecomunicaciones US$155 millones.

Mientras que las de signo negativo o desinversiones correspondieron a minería US$752 millones; electricidad, por US$218 millones, e inmobiliarias, US$25 millones.

El BEM explica que los flujos de Inversión Extranjera Directa (IED) son una de las principales fuentes de capital para alcanzar supuestamente el crecimiento de la economía, proceso de capitalización, acceso a la tecnología, aumento de la empleabilidad y ensanchamiento de los mercados interiores y exteriores en el país destinatario.

Resalta que el más importante motivo de realización de este tipo de inversión de capital obedece a la obtención de altas tasas de rentabilidad por medio de la contracción de costos de explotación de recursos naturales, adquisición de bienes intermedios, contratación de fuerza de trabajo y recepción de exenciones fiscales o pagas de bajas tributaciones.

Destaca que en muchas ocasiones las tributaciones corporativas de las empresas extranjeras ayudan a la fiscalidad del país; pero en otras la serie de exoneraciones y exenciones, la multiplicidad de facilidades no reflejan los reales costes de producción y venta.

Fuente: Periodico Hoy

[:en]

Foreign Direct Investment (FDI) between 2009 and June 2016 amounted to US$17,219 million. According to the Dominican Central Bank and a study by the Energy & Mines Barometer (sic Barómetro de Energía y Minas (BEM)), the main growth areas were commerce and industry at 23.43%, mining 19.31%, real estate 13.24%, tourism, 12.86%, telecommunications, 8.95%, electricity 8.85%; free trade zones 6.82%, and finance 6.53%. The data shows that the mining-electricity sector accounts for 28.16% of all foreign investment in the country.

On average, the growth rate of direct investment in the country was 3.14% from 2010 to 2015, with a peak of 38.02% in 2012, largely due to the large investments by Barrick Pueblo Viejo, and then in 2013, a drop of 36.66% due to large divestitures carried out by several corporations and the steep decline of investment inflows to the country.

Finally, regarding foreign direct investment by country from 2009 to June 2016, the three leading countries are Canada, with 20.79%; United States, 19.43%, and Mexico, 4.32%. They are followed by Spain, with 3.87%; France, 1.21%, and the Netherlands 1.15%, the remaining 49.23% spread over several nations.

The Energy & Mines Barometer shows that this type of investment in no way represents an expansion of real capital, because it accounts for acquisitions or mergers and short-term operating financing. For example, according to data released by ECLAC, between 2009 and 2014, excluding speculative and short-term capital, the structure of direct investment in the Dominican Republic, , consisted of capital contributions: 46.47%, reinvestment of profits: 43.97% and intra-firm loans: 9.55%.

The publication highlights that from 2010 to 2015, the top three direct investment positions were occupied by tourism at US $ 486 million, Free zones at US $ 187 million, and telecommunications at US $ 155 million whereas the down turn or divestments was attributed to mining at US $ 752 million, electricity at US $ 218 million, and real estate at US $ 25 million.

The Energy & Mines Barometer explains how Foreign Direct Investment (FDI) flows are one of the main sources of capital to supposedly achieve economic growth, capitalization, access to technology, increased employability and widening of internal and external markets in the target country.

It emphasizes that the most important reason for conducting this type of capital investment is to achieve high rates of profitability by reducing the costs of natural resource exploitation, intermediate goods purchases, contracting labor force and availing of tax exemptions or low tax rates.

The report emphasizes quite often the corporate taxation of foreign companies helps the country’s taxation often as not the series of exemptions and breaks, and the multiplicity of facilities, do not reflect the actual costs of production and sale.

Source: Hoy Newspaper

[:]