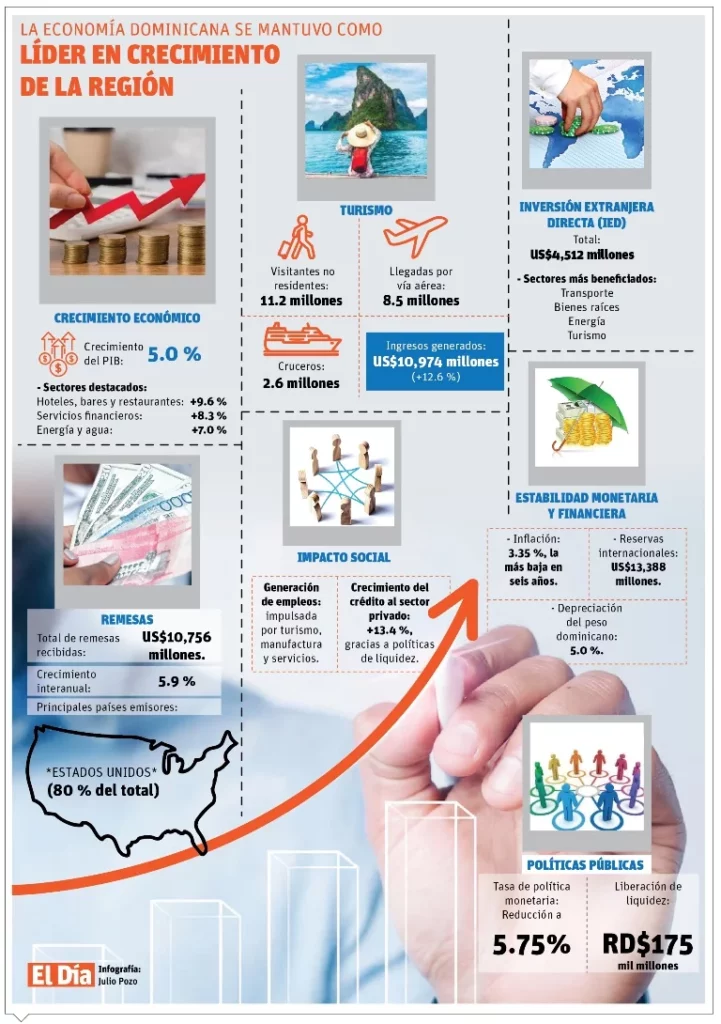

The Dominican economy concluded 2024 with a growth of 5.0% in gross domestic product (GDP), consolidating itself as one of the most dynamic economies in Latin America, managing to overcome adverse external factors such as geopolitical tensions and global monetary adjustments.

According to data from the Central Bank, the country experienced quarterly year-on-year expansions of up to 6.1%, with inflation under control that closed the year at 3.35%, the lowest in the last six years.

This panorama is even more relevant considering the adverse international context, marked by conflicts in Eastern Europe, adjustments in U.S. interest rates, and tensions in global financial markets.

Leading Latin American countries in GDP growth compared to 2023, the main drivers of this performance include sectors such as tourism, remittances, foreign investment and free zones, while at the domestic level, manufacturing, energy, transport and construction stood out.

With the arrival of 11.2 million non-resident visitors, the country reached unprecedented figures. Of these, 8.5 million arrived by air and 2.6 million on cruise ships, generating revenues of US$10,974 million, a year-on-year increase of 12.6% compared to 2023.

This constant flow of tourists energized sectors such as hotels, bars, restaurants and transportation.

Remittances

Remittances sent by the Dominican diaspora set a record of US$10,756 million, with a growth of 5.9% compared to the previous year.

More than 80% of these funds came from the United States, where favorable economic conditions contributed to the increase in shipments. Dominican economic and political stability continued to show that it generates dividends for the country, as foreign direct investment reached US$4,512 million, exceeding US$4,000 million for the third consecutive year.

The sectors that benefited the most were transportation, real estate, energy and tourism. According to the Central Bank report, these investments made it possible to comfortably finance the current account deficit and strengthen economic stability.

The report cited the implementation of policies to ensure macroeconomic stability, including the reduction of the monetary policy rate, which closed at 5.75%, and the release of RD$175 billion in liquidity for the financial system, as factors of the consolidated 2% growth in 2024.

These measures allowed a 13.4% growth in credit to the private sector and stimulated activities such as construction and home purchasing.

The report indicates that the Dominican peso experienced a moderate 5.0% depreciation, lower than that of other economies in the region, which reflected a notable exchange rate stability.

Likewise, international reserves reached US$13,388 million, exceeding the standards of the International Monetary Fund.

Looking ahead to 2025, forecasts indicate that the Dominican Republic will maintain its growth rate, supported by a diversified economy and public policies aimed at stability and development.

Position

Strength

Given this performance, the Central Bank understands that the Dominican economy is in a good position to continue overcoming external and internal challenges that could impact its evolution. The forecast is to maintain growth.

Source: