Mining exports, especially gold and silver alloy (doré) have been growing in recent years, thanks to the increase in their price in the international market, rather than their domestic production, because the extraction of this mineral in the country, paradoxically, has been decreasing.

But these price increases, combined with the contractual conditions between the mining companies and the Dominican State, have facilitated the entry of more resources into the treasury in the form of the taxes they pay for extracting doré.

Although one company stands out as the main contributor (Barrick Pueblo Viejo), which operates one of the largest gold mines in the world, located in the Sánchez Ramírez province, other companies are also gold miners, although in smaller seams.

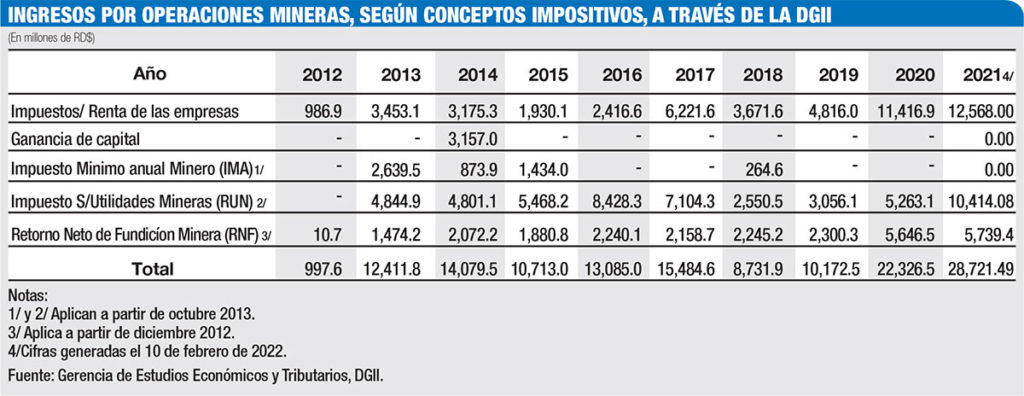

According to statistics from the General Directorate of Internal Taxes (DGII), since operations at the Pueblo Viejo mine resumed in 2012, after decades of inactivity, the revenue collections for its operations have grown every year.

Contributions of mining to the treasury

From 2012 to 2021, Dominican mining contributed to the treasury, through the DGII, an amount amounting to RD$136,723.9 million, last year seeing a greater income, although it was not the one with the highest production.

| DGII Tax revenue for mining operations, according to tax concepts In DOP millions Company Taxes/Income Capital Gains Minimum annual mining tax (IMA)1/ Mining Taxes/Profits 2/ Mining Smelter net Returns 3/ Notes: 1/ and 2/ apply as of October 2013 | 3/ Applies as of December 2012 | 4/ Figures generated 10 February 2022 Source: Department of Economic and Tax Studies, Internal Revenue Department (DGII) |

In 2021, mining operations contributed RD$28,721.4 million, the highest amount in tax payments in the last decade. However, gold production was 44% lower than five years ago. The reason for the increase in collections is because the value of this mineral in the foreign market has almost doubled in the last two years.

Between 2013 and 2019, the average annual contribution of mining operations to the Treasury was RD$12,096.9 million. However, in 2020, the year of the pandemic, mining companies paid US$22,326.5 million, 84.5% above the average of the previous seven years.

The main reason is that in that year, given the paralysis of economic activities in the world, due to the covid-19 pandemic, investors took refuge in gold to ensure the value of their assets, which motivated a shot in the price of that mineral almost doubled.

This increase in gold prices, even with a decrease in extraction operations, the volumes exported generated large profits for the mining companies operating in the country and this resulted in a contribution in payment of taxes.

The same happened during the past year 2021, when prices continued to rise and the State was able to collect RD $ 28,721-4 million, that is, 28.6% more than in 2020 and 137.4% above the annual average of the seven-year period before the pandemic.

Concepts

The collections of the DGII for taxes on mining operations are of different tax concepts: Corporate Income Tax (ISR); capital gain when there was a sale of extraction rights from one company to another; Minimum Annual Mining Tax (IMA), Tax on Mining Profits (PUN) and for the Net Return of Mining Smelter (RNF).

In 2021, the contributions of mining companies for their operations were for THE concept of ISR with RD$12,568 million, for the PUN RD$10,414.1 million and rd$5,739.4 million was reported from the RNF.

Gold Quote

In January 2019, the year before the pandemic, gold was trading at $1,384 a troy ounce; by January 2020, when the economic effects of the virus were not yet felt, it had risen to $1,626 and continued to rise throughout that year while economic activities came to a standstill.

By January 2021, the average price of this mineral, which is generally used as a refuge for investors in times of crisis, its price stood at US$1,859.50.

It remained on the rise throughout 2021 with varying levels reaching around $2,000 a troy ounce. As of March of this year, the average price was US$1,949.20.

Those increases in international gold prices are what have contributed to higher profits for extractive companies like Barrick Pueblo Viejo in the Dominican Republic. However, its profits would be much higher if it maintained the same production levels of previous years.

It is estimated that the production and export of doré volumes (gold and silver) from the mine have been reduced by more than 40% in the last five years. Even so, the values exported grew and equally their contributions to the State in the form of taxes.

Source:

El Dinero