The Central Bank of the Dominican Republic said today that the year 2021 just ended would be remembered for the extensive efforts of the international community to reactivate the world economy in an environment in which risks persist associated with new variants of the coronavirus.

The body indicated that in the case of the Dominican Republic (DR), the recovery achieved had been valued as the success story by the international community, highlighting the opinions of the most prestigious risk rating agencies, of the most representative institutions of international banking and various multilateral organizations.

“In general terms, all these entities have favorably weighed the implementation of macroeconomic policies consistent with the objectives of achieving the recovery of productive activities, recovering jobs and protecting the most vulnerable segments of the population,” says a statement from the Central bank.

It explains that, since the World Health Organization (WHO) declared the coronavirus a pandemic in March 2020, the Central Bank of the Dominican Republic (BCRD) implemented an expansionary monetary policy that included the reduction of the interest rate of reference from 4.5% to 3.0% and the implementation of various liquidity mechanisms, aimed at creating the conditions for financial institutions to be able to place and/or refinance low-cost loans to Dominican businesses and households.

At the same time, the government designed social programs to protect the most defenseless groups of the population and relaxed the tax burden on companies, particularly in the sectors most affected by the pandemic, preserving jobs, and protecting people’s income.

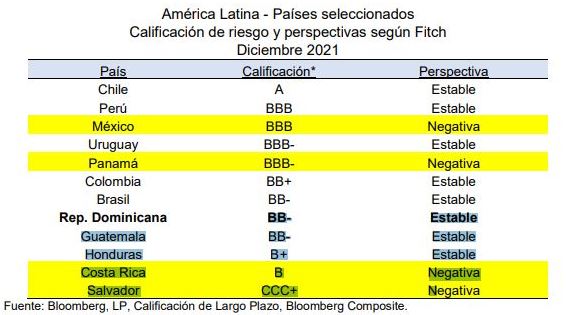

In December of this year, two risk rating agencies of great international prestige, Standard and Poor’s and Fitch, have released their assessments of the future performance of the Dominican economy, which have resulted in an improvement in the outlook from negative to stable.

It should be noted that, throughout 2021, only one country achieved a favorable review from the two major rating agencies in all Latin America and it was precisely the DR.

The rating agencies recognize that the greater-than-expected economic rebound has mitigated much of the fiscal risk, while efficiency gains have been achieved in spending management, while they see the gradual implementation of the electricity sector reform as positive, which will undoubtedly continue to improve the projection of the debt/GDP ratio on a more sustainable path.

Likewise, last November, the country achieved a historical figure receiving some 519,349 visitors, which allows us to project that the number of visitors for the entire year would be above 5 million.

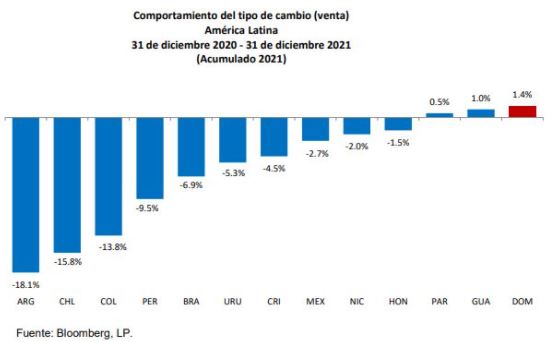

International reserves are expected to close the year around to US$12.8 billion, 13.8% of GDP. Perhaps the most important thing is that reserves have been accumulated at a time when the Dominican peso has appreciated, in contrast to the depreciations observed in almost all Latin American nations, as can be seen in the following graph.

Despite the success achieved to date, the Central Bank assures that various risks persist on the international scene.

Related to the new variants of the virus detected in various countries and to global price pressures that have intensified during the economic recovery.

This last element has brought with it a change in the monetary cycle of the countries that, in many cases, have accelerated the withdrawal of monetary stimuli and the normalization of the levels of monetary policy rates with the aim of moderating inflationary pressures and defend macroeconomic stability.

Source:

El Caribe