The Central Bank of the Dominican Republic (BCRD), in its interest to keep economic agents and the public adequately informed, and as part of its institutional commitment to transparency and timely data dissemination under its responsibility, reports the preliminary results of economic activity as of September 2024.

The Monthly Economic Activity Indicator (IMAE) recorded an expansion of 4.7% during September of this year, resulting in an average year-on-year growth of 5.1% from January to September 2024. This performance has occurred in an environment of price stability, with inflation remaining in the lower range of the target of 4.0% ± 1.0% this year, due to the monetary and fiscal policies implemented, which have effectively navigated the risk factors impacting the Dominican economy.

In this regard, it is important to highlight that the observed trajectory of economic activity demonstrates the resilience of the national productive apparatus in the current global context, where the expectations of economic agents have been affected by the uncertainty associated with geopolitical conflicts in the Middle East and Eastern Europe.

Despite the global outlook, the United States of America (USA), the country’s main trading partner, reported a year-on-year growth of 2.7% in the third quarter of 2024. Additionally, year-on-year inflation was 2.4% in September of this year, showing a smooth landing towards its target. Meanwhile, the Federal Reserve decided in its most recent meeting in September to reduce its benchmark interest rate by 50 basis points (bps), and it is expected to continue decreasing in the remaining period of 2024. In this context, the International Monetary Fund (IMF) raised its growth projection for 2024 to 2.8%, an increase of 0.2 percentage points.

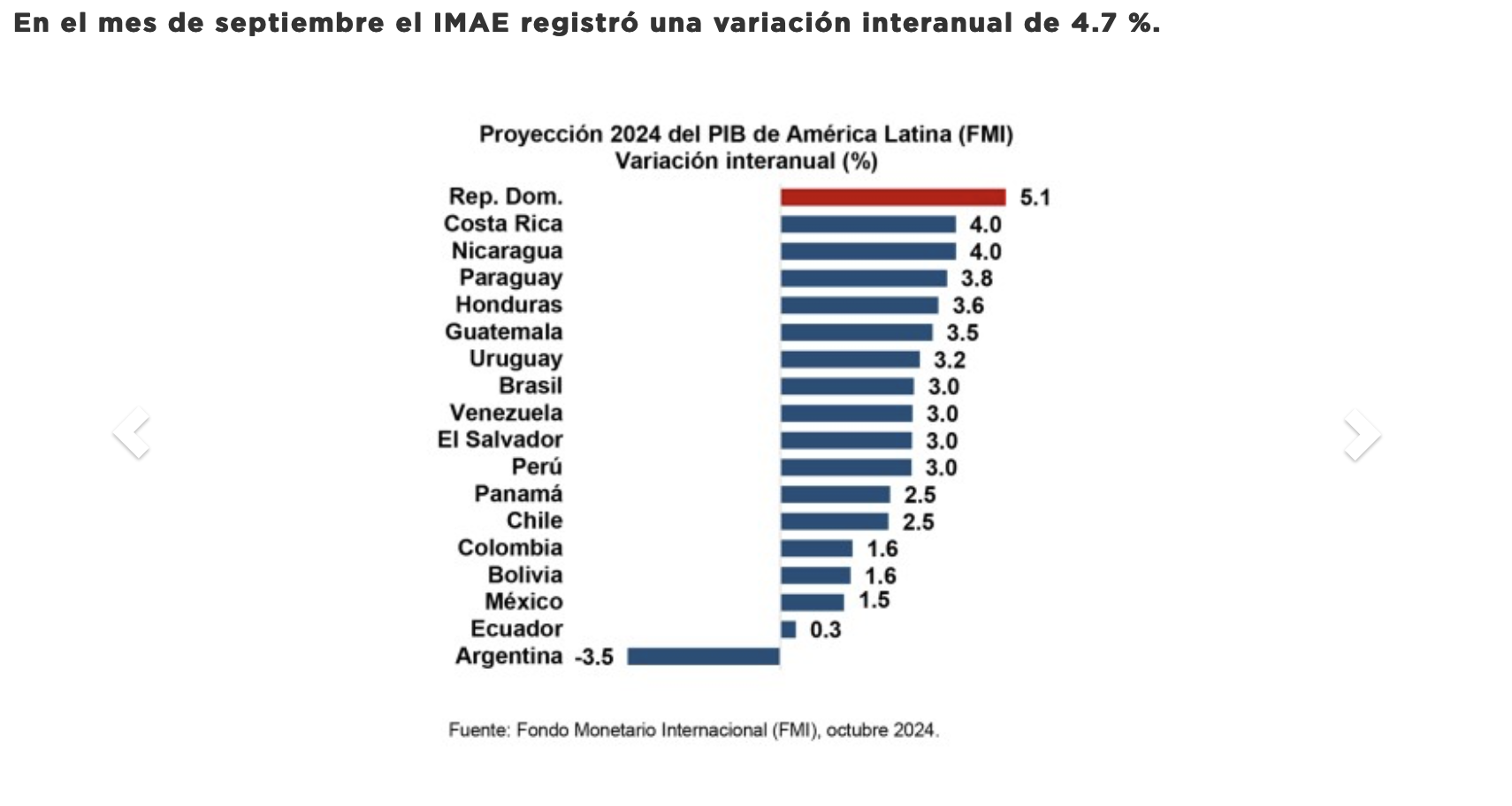

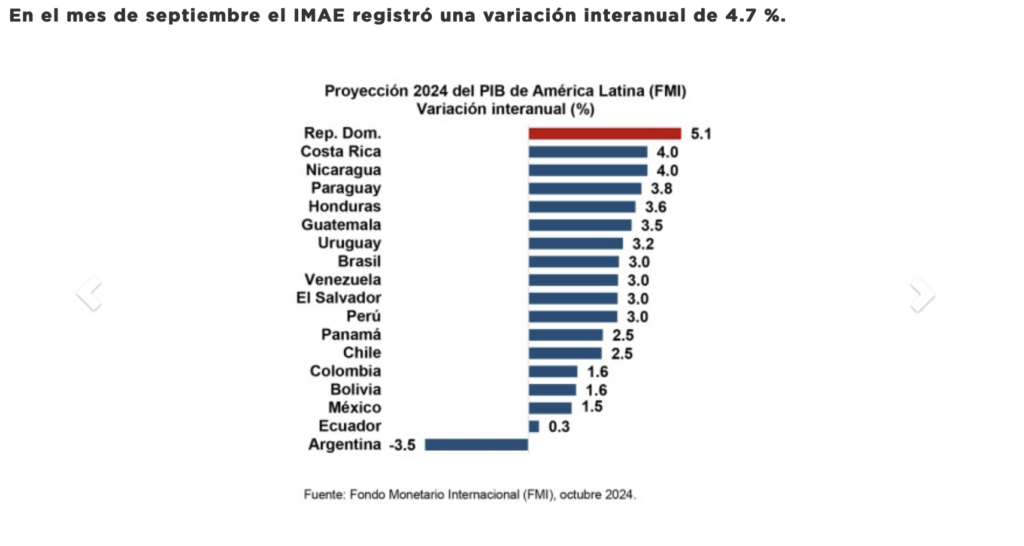

Furthermore, the expansion of the IMAE from January to September positions the Dominican Republic as the economy with the highest year-on-year increase compared to its Latin American peers, according to the latest available information published by the countries. This result aligns with the forecasts of various international organizations and the government’s inter-institutional macroeconomic framework, whose projections indicate an expansion around 5.0% and position the country as a leader in economic activity growth in the region for the end of 2024.

The year-on-year variation of 5.1% from January to September 2024 is attributed to the performance of sectors such as construction (4.4%) and free zone manufacturing (6.5%), noting that exports under this regime amounted to US$6,404.1 million during this period. Additionally, service activities collectively showed an accumulated increase of 5.3% compared to the same period last year, with notable growth in financial intermediation (7.9%), hotels, bars, and restaurants (6.3%), transportation and storage (5.9%), real estate and rental activities (5.7%), and communications (5.1%).

Regarding financial intermediation, this sector experienced a year-on-year increase in its real added value of 7.9% from January to September, influenced by a 16.2% expansion in credit granted to the private sector in national currency, equivalent to RD$309,554.3 million more compared to September of the previous year.

An important aspect to highlight is that, although mining recorded an average year-on-year variation of -6.1% from January to September, this sector had positive results in August at 8.5% and September at 16.9%, supported by increased gold production at the country’s main mining site.

In terms of construction, this sector showed a year-on-year variation of 4.4% in the January to September period, which is reflected in the increase in sales volumes of the main inputs used in infrastructure development projects.

As for the added value of the hotels, bars, and restaurants sector, it experienced a year-on-year variation of 6.3% from January to September, significantly influenced by the arrival of passengers through various airport terminals. By the end of this year, it is projected that approximately 8.5 million tourists will be received.

Finally, the Dominican economy is in a good position to maintain a growth rate around its potential, considering the strength of its macroeconomic fundamentals, the resilience of productive sectors, and the improvement in country risk indicators in international markets.

*Source: Central Bank of the Dominican Republic

Source: