When Jesus began working in the call center industry 12 years ago, he was looking for a job to strengthen his language studies, with a competitive salary, and, additionally, one that was close to his residence in the 30 de Mayo sector.

For this young man, who chose to withhold his last name citing professional reasons, finding such a job was not a problem: dozens of these companies have settled in the main intersections of the central polygon of the National District, protected by their status as Free Trade Zones for Services granted by Law 8-90.

These companies offer increasingly varied and specialized services: from the well-known ones such as customer service, order taking, or conflict resolution, to financial audits, network and platform support, software development, or telemedicine.

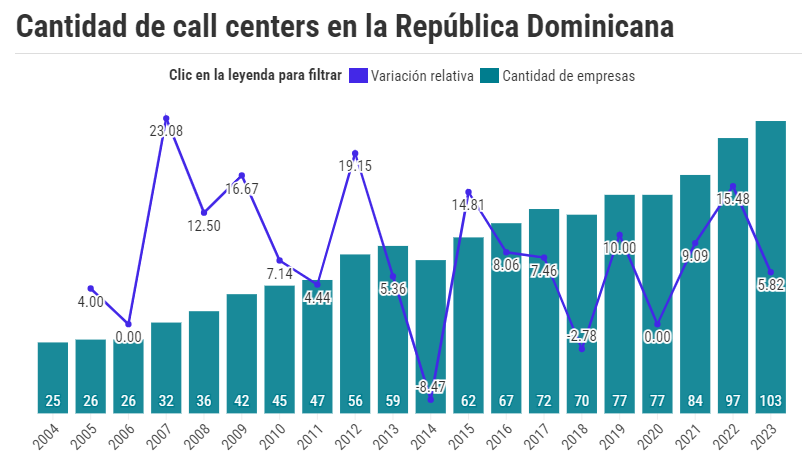

The Dominican Association of Free Trade Zones (Adozona) indicates that there were 103 operational call centers nationwide as of the end of 2023, with the urban areas of the National District, Santiago, and Santo Domingo hosting the highest concentration of these industries, accounting for 49.5%, 23.3%, and 12.6% respectively.

Its president, Daniel Liranzo, points out that the search for increasingly technified labor profiles is one of the main reasons why these industries are seeking to establish themselves closer to the city center.

“The work of call centers is no longer what one traditionally knew, which was receiving calls and assisting a person over the phone. Apart from that, it’s a technical support and assistance service through a computer,” he added.

In agreement with this is the coordinator of the Contact Center and BPO Cluster, Giacomo Traverso: “Due to population growth in cities, mainly in Santo Domingo and Santiago, the particular needs of customers and the proximity for employees, the concentration of call centers in metropolitan areas is higher nowadays,” he stated.

Jesus’s work experience is a testimony to this: he has transitioned from working on projects related to customer service in the financial and hotel industries to currently providing technical support in web design and management to users in the United States.

It’s understood that not all projects managed by a call center have the capacity to be located in such expansive areas as a free trade zone park, traditionally distant from urban centers. “It wouldn’t be beneficial. They (entrepreneurs in this industry) rent towers and buildings that are much more economical for them, with annual contracts,” he observed.

As of 2023, only 18.4% of call centers were located within free trade zones, such as San Cristóbal, San Isidro, La Romana I, Las Américas, Santiago, Gurabo, and the technological free trade zone of Herrera. According to data from Adozona, 81.6% of these companies are call centers in service free trade zones and special free trade zones.

The service offering evolves. Traverso indicated to Diario Libre that the beginning of this industry in the Dominican Republic was marked by the inauguration, in the late 1990s, of Opitel.

It was a company owned by the Dominican Telephone Company (Codetel) to provide outsourcing services for customer service and other related services, and it was the first contact center in the country.

Since then, the Dominican Republic has remained an attractive destination for those interested in investing in this segment, providing services to countries such as the United States, Canada, Haiti, Costa Rica, Brazil, France, or China.

Among the advantages valued by investors, the executive highlighted:

- Nearshoring, as the country shares similar time zones with the countries it serves.

- High degree of affinity with American culture.

- Moderately high and educated young population.

- Neutral English language accent.

- Competitive cost.

- Capabilities to perform various simple and sophisticated tasks.

- Government support and sector leadership at the regional level.

This has led the country to have companies operating within the three existing modalities in the contact center industry:

Business Process Outsourcing (BPO), which offers services such as customer service, order taking, complaints handling, content mediation, telemarketing, dispatches, membership services, retention, human resources management, among others.

Knowledge Process Outsourcing (KPO), which are companies dedicated to offering consultancy and analysis in business matters, market intelligence, financial and compliance audits, training, and telemedicine.

Information Technology Outsourcing (ITO), specialized in the development and maintenance of websites, support for systems such as networks and platforms, graphic design, software development and maintenance, user technical support, and network administration, security, among other aspects.

In 2022, the cumulative investment of call centers in the Dominican Republic amounted to $400.1 million, with special free trade zones and service zones in the National District covering the highest amounts, totaling $197 million just in that year.

By the end of 2023, the total investment amounted to $433 million, marking a 62.4% increase from the $163.4 million that this subsector of free trade zones had attracted to the country nine years ago, in 2014, with just 54 companies installed in the country.

Salary: What Employees Value Most

And for employees, why is it so appealing to work for a call center? Jesus, with over a decade of experience in this field, responded without hesitation: the salary.

As a language student, he hesitated whether to focus his skills on the hotel sector or on teaching. However, he found that call centers offer flexible hours, the ability to switch projects, and pay for overtime.

“There are projects where you can earn more than a teacher,” added the young man, not overlooking the sacrifice of enduring shifts of up to 14 hours to achieve it.

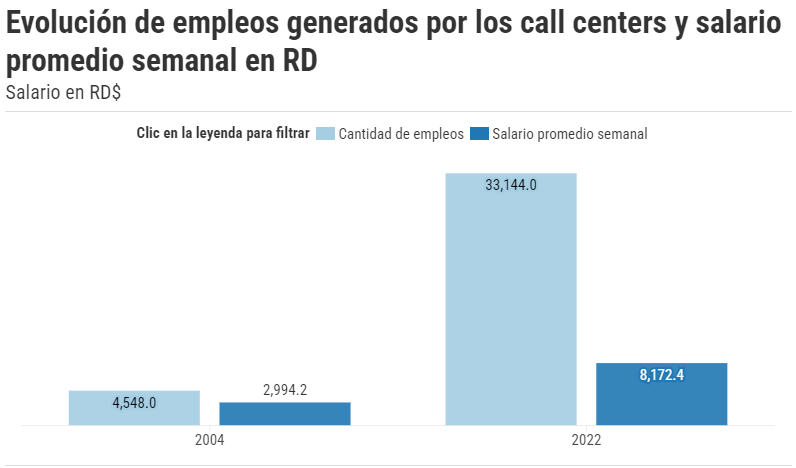

These motivations are shared by many of the 34,649 people who were working in this sector in 2023, a workforce that placed it as the third largest job generator in the Dominican economy that year, after the tobacco sector and textile manufacturing.

Compensation has also improved over time. In 2022, Adozona estimated the average weekly salary at 8,172.4 pesos, a significant improvement compared to the 2,994 pesos per week paid in 2004 when there were far fewer companies.

However, this margin could be even higher: Jesus assured that there are call center services that pay between 20 and 25 dollars per hour (between 1,188 pesos and 1,485 pesos), while the same work can cost between 3 and 5 dollars (between 178 pesos and 297 pesos).

The Benefit of Remote Work

Remote work is becoming increasingly popular among call center workers, offering the advantage of even working directly with companies outside the country.

Mayobanex Díaz is one of those employees who chose this modality after securing an offer that allows him to schedule vehicle appointments for a company based in the southern United States.

“There is better time management, a real reduction in the costs of having a job and going out, and there are certain comforts,” he acknowledged.

He pointed out that the opportunity has allowed him to secure a fixed salary, which he broke down to 8 dollars per hour (475 pesos), a competitive rate compared to what is paid in the Dominican market.

However, being a company based outside the country, Díaz has had to make voluntary contributions to the Social Security Treasury (TSS) and to his health insurance to continue with his contributions and premiums within the formal market.

Bilingualism. Among the Challenges

Even though Dominicans may have a neutral accent in the English language and increasingly possess more specialized skills to offer services to multiple companies, the coordinator of the Contact Center and BPO Cluster stated that there is a need for more qualified human talent in the language to meet the sector’s demand.

“Our country lacks a culture of bilingualism, and the programs driven by the Government (…) do not meet the English competency requirements demanded by companies,” he expressed.

The cluster has identified the need for around 9,750 bilingual employees per year, thus considering that investment in greater education and training programs is necessary as part of a comprehensive strategy to benefit the industry.

This would also require bolstering the country’s technological infrastructure, streamlining bureaucratic procedures to attract greater investments, and continuing to promote the country as a destination for the outsourcing of modern services.

Source: